Category: Blog

-

Managing your finances effectively is one of the most important steps toward achieving financial stability and reaching your long-term goals. Tracking monthly expenses can help you understand where your money is going, identify areas where you might be overspending, and ultimately save more money. While it may seem like a daunting task at first, there…

-

Building an emergency fund is one of the most important steps you can take to achieve financial security. Life is unpredictable, and unexpected expenses can arise at any time. Whether it’s a medical bill, car repair, or job loss, having an emergency fund ensures that you are prepared to handle these challenges without falling into…

-

Debt can be a heavy burden, but with the right tools and strategies, you can create a plan to eliminate it and achieve financial freedom. One of the most effective ways to tackle debt is by using online financial calculators. These tools are designed to simplify complex calculations, provide insights into your financial situation, and…

-

In today’s fast-paced world, managing money has become an essential skill for individuals of all ages. With the increasing complexity of financial systems and the growing number of financial products available, it can be challenging to keep track of expenses, savings, investments, and other financial activities. However, technology has emerged as a game-changer in simplifying…

-

Saving money is an essential part of financial planning. It helps you prepare for emergencies, achieve your dreams, and secure a stable future. However, many people struggle to set realistic savings goals and stick to them. This article will provide detailed insights into the best practices for setting achievable savings goals and strategies to ensure…

-

Debt repayment is a critical topic for many individuals and families. Whether it’s student loans, credit card debt, mortgages, or auto loans, managing debt effectively can significantly impact your financial well-being. This article will provide a detailed guide to understanding debt repayment plans and offer expert-backed tips to help you tackle your financial obligations. What…

-

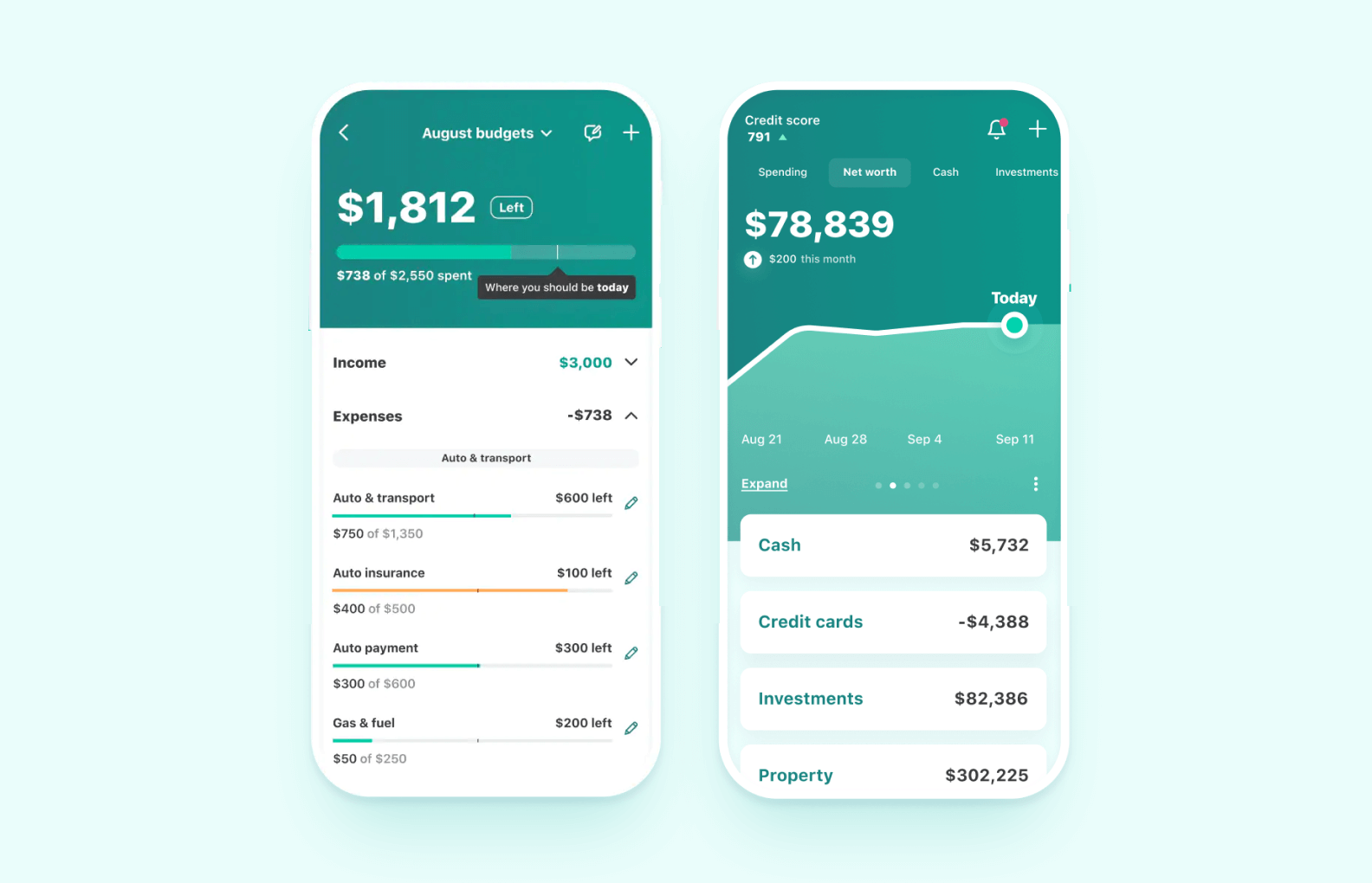

In today’s fast-paced world, managing personal finances can be a daunting task. With the rise of digital technology, personal finance apps have become an essential tool for individuals looking to take control of their spending habits. These apps are designed to simplify budgeting, track expenses, and help users make informed financial decisions. If you’re wondering…

-

In today’s fast-paced and unpredictable economy, managing personal finances has become more important than ever. With rising inflation, fluctuating incomes, and increasing costs of living, it’s easy to lose track of where your money is going. This is where an expense tracker becomes a crucial tool for every household. An expense tracker helps you monitor…

-

When it comes to managing finances, understanding how to calculate loan payments is a critical skill. Whether you’re planning to take out a mortgage, car loan, or personal loan, knowing the exact amount you’ll need to pay each month can help you budget effectively and make informed financial decisions. This guide will walk you through…

-

Managing personal finances can be a challenging task, especially when you have multiple expenses, savings goals, and debts to keep track of. A personal finance calculator is an essential tool that simplifies budgeting and helps you make informed financial decisions. Whether you’re trying to save for a big purchase, pay off debt, or simply manage…